FAQ

a. General

How do I top up my account

For the various payment types and instructions on topping up the account, you can refer to our payment FAQs.

What are the fees involved?

You may have more details about our fees and charges over here:

Is there an initial top up I need to fulfil?

Yes there is. As part of the account opening identity verification procedure, you are required to successfully transfer HKD10,000 from your registered Hong Kong licensed bank account to J.P. Morgan Asset Management pursuant to local regulatory requirements. Please ensure the bank account have at least HKD10,000 as it will be immediately debited once the application is received, and it will be temporarily invested in JPMorgan Money Fund – HK$.

- There are no subscription charge for investing in JPMorgan Money Fund – HKD.

- Once the account has been successfully opened, you can choose to switch the investment and invest within your account in any of our funds in accordance to your risk appetite and investment objectives, or redeem from the fund if you wish. (Refer to the Dealing Guide for details)

- If account opening is unsuccessful, the HKD10,000 will directly be refunded to the same bank account provided (Please note that your bank may impose charges on the refund).

- Please note that investments involves risks. Please refer to the offering document(s) for details, including the risk factors. Investing in JPMorgan Money Fund – HKD is not the same as making a deposit with a bank or deposit-taking company.

Applicable for account opened online on or after 27Feb2024:

To open a MasterAccount online with Cash Account service, you have to submit your account opening application online (you may find the details here). As part of the account opening identity verification procedure, you are required to successfully transfer HKD10,000 from your registered Specified Bank account to JPMorgan Funds (Asia) Limited pursuant to local regulatory requirements. This HKD10,000 will be available as Cash Account balance under your MasterAccount if account opening is successful. If account opening is unsuccessful, the HKD10,000 will directly be refunded to the same bank account provided (Please note that your bank may impose charges on the refund).

Initial Charge

Redemption Charge

Normally 0% for all funds, except JPMAM (China) Fund Range. For the detailed redemption charges of JPMAM (China) Fund Range, please refer to your fund contract.

How can I top up my cash account balance? (Applicable for account opened online on or after 27Feb2024)

Please login to J.P. Morgan DIRECT Investment Platform and at the top menu, select "Cash Account” > “Top-up"

What is the minimum top-up amount for Cash Account services? (Applicable for account opened online on or after 27Feb2024)

Minimum top-up amount is HKD $1,000.

How can I withdraw the cash balance from my Cash Account? Any minimum withdrawal amount from Cash Account? (Applicable for account opened online on or after 27Feb2024)

If you wish to withdraw from the balance of your Cash Account, please login to J.P. Morgan Direct Investment Platform and go to “Cash Account” > “Withdrawal”.

The minimum withdrawal amount for Cash Account service is HKD $5,000. If the remaining balance is less than HKD $5,000, you are required to withdraw the full remaining balance.

When will I receive my money after placing a withdrawal instruction from my cash account? (Applicable for account opened online on or after 27Feb2024)

Normally withdrawals from the Cash Account will be paid within 5 business days, subject to the processing time of your own account bank.

b. Buy Funds

What is the minimum amount for each Investment?

For online lump sum investment it will be HKD5,000 or its equivalent in another currency per fund/share class in general.The exception will be RMB100 for JPMAM (China) Fund Range.

For monthly investment it will be HKD1,000 or its equivalent in another currency per fund/share class in general.

Please refer to the dealing guide for more information.

Aside from the special discount, what are the benefits of using J.P. Morgan eTrading?

Our all-in-one eTrading platform offers easy access to our comprehensive range of funds and investment services. You can place instructions online to buy, sell or switch funds, gain insights from our latest investment ideas and enjoy the privileges with our exclusive eScheduler, Price Alert and ePoints Rewards services.

To learn about our special privileges, please visit the link here.

What are the normal dealing hours?

Our normal dealing hours are from 9:00am to 5:00pm (HK time) Monday to Friday, except when banks in Hong Kong are closed and when a fund has a significant holding in a market that is closed (e.g., for a local holiday). Under certain circumstances, a particular fund may experience dealing suspensions. Please refer to the relevant fund’s offering documents for details. You can also place your instruction online via J.P. Morgan eTrading which operates 24 hours a day. The cut-off time is 5:00pm (or 3:00pm for JPMAM (China) Fund Range and administrative units and investment units of JPMorgan Provident Funds) of the relevant dealing day for funds which deal on a daily basis. Orders received after the cut-off time will be processed on the next relevant dealing day.

Please refer to the dealing guide for more information.

What is the cut off time if I place my order through J.P. Morgan eTrading?

As our dealing hours are 9:00am to 5:00pm (HK time) Monday to Friday, except when banks in Hong Kong are closed and when a fund has a significant holding in a market that is closed (e.g. for a local holiday). The cut-off time for dealing through J.P. Morgan eTrading is 5:00pm (HK time) (or 3:00pm (HK time) for JPMAM (China) Fund Range and administrative units and investment units of JPMorgan Provident Funds) on any dealing day of the fund(s) you wish to deal in. Orders received after the dealing cut-off time will be processed on the next relevant dealing day.

Please note that for some payment methods, payment cut-off time may be earlier than the dealing cut-off time above, and thus you may need to place orders earlier if they are to be settled by those payment methods (e.g., Autopay).

For details of various payment methods’ payment cut-off times, please refer to this page and refer to the guides there.

Please refer to the dealing guide for more information.

When will my subscription order be processed if the day on which I place my order is not a dealing day?

Your order will be processed on the next relevant dealing day provided the order and payment are received by us before the dealing cut-off time.

Example 1

If the order is placed on Saturday or Sunday (which are not dealing days), the deal will be processed on the following Monday provided that Monday is a dealing day.

Example 2

If the order is placed on a Hong Kong Public Holiday, or on a day when banks in Hong Kong are closed, or when a fund has a significant holding in a market that is closed, it will be executed on the next dealing day.

When will my order be processed?

Provided all relevant orders and payments are received before the dealing deadline, orders will generally be processed at that dealing day's closing price and the price will normally be published on the next business day. The only exception is:

JPMorgan Funds - US Dollar Money Market Fund and JPMorgan Money Fund - HK$:

Orders will normally be processed on the dealing day on which we have received your electronic payment (if orders are placed through J.P. Morgan eTrading). The payment must be received by us before the dealing cut off time at 5:00pm (HK time).

Upon confirmation of the deal, a Contract Note confirming the details will be sent to you.

IMPORTANT: For online banking payments, as the cut-off time varies from bank to bank, please check the payment service offered by your bank.

How do I buy additional units/shares?

Eligible clients can buy additional units/shares through J.P. Morgan eTrading, make payment directly online. Please refer to the this link for some illustrations:

For JPMAM (China) Fund Range, RMB Standing Payment Instructions for redemption is required before subcription.

Under what circumstances will an order be rejected?

An order may be rejected if your payment is NOT made:

- in the exact amount of your total order, i.e., if you overpay or underpay, even in cents.

Example: If the amount of your total order is HK$50,500 but your payment is HK$50,549 or HK$50,501, your order will be rejected.

- before the cut-off time of of your preferred payment method as indicated in the table below.

- through the designated electronic channels. Currently, we accept RMB HSBC Autopay, FPS, HSBC bill Payment, Real time Direct debit and money transfer.

- If your payments cannot be successfully debited from your Autopay bank account for subscription orders.

- If there is no sufficient funds in your Autopay bank account to settle the scheduled order(s) before 3:00pm on the SAME business day on which you placed the order.

What happens if my order is rejected after the money has been transferred to J.P. Morgan account?

The total amount will be parked in JPMorgan Money Fund - HK$ and can be switched to other funds once the settlement is completed.

Can I cancel my order(s)?

For information on whether your order can be cancelled, kindly refer to the table here under the payment type you have selected.

What happens if I cancel the order, however the money has been transferred to J.P. Morgan account?

The total amount will be parked in JPMorgan Money Fund - HK$ and can be switched to other funds on the next dealing day.

How do I cancel my order?

Simply click Order Status under "eTrading" on the menu bar and press "Cancel" under the related deal number of the order you wish to cancel.

For detailed instructions, please visit the link here.

Kindly view the table below for more information about the cancellation cut-off time and exceptions:

Will my order be accepted if the connection to J.P. Morgan eTrading site is interrupted but I have pressed the "Confirm" button?

If your connection to J.P. Morgan eTrading site is interrupted during the process, we strongly suggest that you login again to check whether or not the submitted deal has been successfully recorded in the Order Status screen. Normally order(s) would be deemed successful if the deal number is issued on the "Order Receipt" screen.

How do I know if my order has been accepted?

An "eConfirmation" will be sent to your registered email address showing the status of your order. You can also check by going to Order Status to view details of your orders for the current business day. For details of completed transactions, please go to Order History.

How can I get the finalised order details?

You can go to Order History, after the transaction is completed. The "Contract Note" will provide the actual dealing date, which may differ in certain circumstance from the date shown in the "Order Receipt" screen, the eAcknowledgement and the eConfirmation, e.g. when offices are closed due to the hoisting of typhoon signal No. 8 (or above) or Black Rain Storm.

How can I subscribe fund using Cash Account balance? (Applicable for account opened online on or after 27Feb2024)

You may select “Cash Account” for “Payment Method” on J.P. Morgan DIRECT Investment Platform, fund subscription payment will debit from cash account directly. If there is insufficient balance, Client will have to top-up Cash account before subscripting funds.

Please note that if you wish to invest with currency other than HKD, you may only choose “Money Transfer” under “Payment Method”.

c. Sell Funds

What is the minimum amount I can redeem through J.P. Morgan eTrading?

The minimum redemption amount through J.P. Morgan eTrading is HK$5,000 per fund.

If I wish to make a partial redemption, do I have to leave a minimum balance in my MasterAccount?

Yes, if you are making a partial redemption, the residual balance in each fund must normally meet the investment minimum, otherwise you have to sell all of your holdings in that fund/share.

If you are using eTrading for full/partial redemption, the residual balance in each fund must meet the investment minimum $5,000 or the monthly minimum of the eScheduler of HKD$1,000 otherwise you have to sell all of your holdings in that fund/share.

If you wish to make a partial redemption for JPMAM (China) Fund Range, please ensure the residual fund balance is a minimal of 100 unit of the funds otherwise you have to sell all of your holdings in that fund/share.

The Investment Minimum is the minimum initial lump sum investment. In most funds/share classes it is USD2,000. Exceptions: USD5,000 for JPMorgan Evergreen Fund, RMB100 for JPMAM (China) Fund Range.

What is the dealing cut-off time if I redeem holdings through J.P. Morgan eTrading?

The dealing cut-off time is 5:00pm on the relevant dealing day for our funds which deal on a daily basis (except the "Administration Units" and "Investment Units" of JPMorgan Provident Funds and JPMAM (China) Fund Range for which the cut-off time is 3:00pm). Orders received after the cut-off time will be processed on the next relevant dealing day.

Can the proceeds from the redemption of units/shares through J.P. Morgan eTrading be paid by cheque?

No. It is a requirement of J.P. Morgan eTrading that all redemption proceeds be paid directly into the bank account(s) specified in your Standing Payment Instructions (SPI).

Before you can start placing redemption orders online, you must provide us with your Standing Payment Instructions. To change/add any bank account to your Standing Payment Instructions, you may download the hardcopy MA Amendment form here.

After the submission, we will perform a callback to confirm the instructions.

Can the proceeds from the sale of units/shares be made to third parties?

No. Redemption proceeds cannot be made to accounts in the name(s) of third parties.

How quickly will I receive my redemption proceeds?

Normally the proceeds from a sale will be released within 5 -14 business days.

Can I cancel my order(s)?

Orders (Except redeeming from the "Administration Units" and "Investment Units" of JPMorgan Provident Funds) can be cancelled before the cut-off time of 5:00pm on the same business day on which you place the order.

Example 1: If you placed an order at 5:00pm on Monday, which is a business day, you can cancel it before 5:00pm on that day.

Example 2: If you placed an order at 5:00pm on Monday, which is a Hong Kong public holiday, you can cancel it before 5:00pm on Tuesday.

Orders for JPMAM (China) Fund Range and P Funds can be cancelled before the cut-off time of 3pm on the same business day on which you place the order.

For a detailed guide, please visit the link here.

How do I cancel my order?

Simply click Order Status under "eTrading" on the menu bar and press "Cancel" under the related deal number of the order you wish to cancel.

If you do not see a cancel option, this means that the order is unable to be cancelled.

For a detailed guide, please visit the link here.

Where can I obtain my finalised order details?

Please go to Order History, after the transaction is completed. The "Contract Note" will provide the actual dealing date, which may differ in certain circumstances from the date shown in the "Order Receipt" screen, eAcknowledgement and eConfirmation, e.g. when offices are closed due to the hoisting of typhoon signal No. 8 (or above) or Black Rain Storm.

d. Switch Funds

What is the minimum investment for a switching order through J.P. Morgan eTrading?

The minimum investment for switching via J.P. Morgan eTrading is HK$5,000 per fund.

If I wish to make a partial sale or switching, do I have to leave a minimum balance in my MasterAccount?

Yes. If you are switching, the minimum investment requirement as specified for that particular fund/share class must remain in the fund/share class from which you are switching from. Otherwise, all your holdings in that fund/share class will be automatically switched.

With the exception of JPMAM (China) Fund Range, if you are making a switch through J.P. Morgan eTrading, the residual balance in each fund must normally meet the HKD5,000 minimum for lump sum investment, or HKD1,000 minimum for eScheduler's monthly investment, otherwise you have to switch out all of your holdings in that fund/share class.

What is the dealing cut-off time if I switch holdings through J.P. Morgan eTrading?

The dealing cut-off time is 5:00pm on the relevant dealing day for our funds which deal on a daily basis (except the "Administration Units" and "Investment Units" of JPMorgan Provident Funds and JPMAM (China) Fund Range for which the cut-off time is 3:00pm). Orders received after the cut-off time will be processed on the next relevant dealing day.

When will my switch order be processed?

Switching within the same fund range will normally be completed on the same day, except where the switch is made into JPMorgan Money Fund - HK$.

If the switching is made into JPMorgan Money Fund - HK$, units/shares will not be purchased until we have received the sale proceeds from the fund to be sold, normally within 5-14 business days.

For any switching across JPMorgan Funds/JPMorgan Investment Funds (collectively the “SICAV Range”) and JPMorgan Funds (the “Unit Trust Range”), normally the switch sell will be effected on the dealing day (i.e. Day T) and switch buy will be effected on the next dealing day (i.e. Day T+1), except for some funds to be switched into JPMorgan Funds – US Dollar Money Market Fund.

Cleared funds must be received for any switching to JPMorgan Funds - US Dollar Money Market Fund from JPMorgan India Fund, JPMorgan India Smaller Companies Fund and JPMorgan Philippine Fund, which normally require 7 business days to release proceeds, or from JPMorgan Vietnam Opportunities Fund, which normally requires 14 business days to release proceeds.

If the fund to be sold is not valued on the day we receive instructions, the switching (sell and buy) will be carried out on the next dealing day of the respective funds to be sold and purchased.

In the event that the fund to be purchased is not valued on a particular day, the allotment deal will be effected on the next dealing day of that fund.

A switching charge of 1% is normally charged for switching between equity and bond funds, or from money/liquidity funds to equity or bond funds. If you initially invest in a money/liquidity fund at 0% initial charge, and subsequently switch from such fund to an equity or bond fund, an initial charge will be applied.

Switching from/to JPMAM (China) Fund Range is disallowed.

Can I cancel my order(s) for switching?

Orders (Except switching holdings from the "Administration Units" and "Investment Units" of JPMorgan Provident Funds) can be cancelled before the cut-of time of 5:00pm on the same business day on which you place the order.

Example 1: If you placed an order at 5:00pm on Monday, which is a business day, you can cancel it before 5:00pm on that day.

Example 2: If you placed an order at 5:00pm on Monday, which is a Hong Kong public holiday, you can cancel it before 5:00pm on Tuesday.

How do I cancel my order for switching?

Simply click Order Status under "eTrading" on the menu bar and press "Cancel" under the related deal number of the order you wish to cancel.

If you do not see a cancel option, this means that the order is unable to be cancelled.

If I hold both old and new money in Money/Liquidity Funds, how should I place the switch orders to enjoy the special online discount?

You do not need to specify whether you wish to switch old or new money from Money/Liquidity Fund. The system will automatically allocate the portion of your holdings to be switched out in order to minimise your switch charge.

Where can I obtain my finalised order details?

Please go to Order History, after the transaction is completed. The "Contract Note" will provide the actual dealing date, which may differ in certain circumstances from the date shown in the "Order Receipt" screen, eAcknowledgement and eConfirmation, e.g. when offices are closed due to the hoisting of typhoon signal No. 8 (or above) or Black Rain Storm.

e. Transfer Funds

What is the procedures to transfer my holdings?

For each instruction to transfer holdings from one MasterAccount to another MasterAccount or financial institution, the handling fee shall be 0.5% of the latest net asset value of the Units and/or Shares being transferred (as ascertained at the time JPMFAL confirms such transfer instruction with the MasterAccount holder), or HKD250 (or its equivalent in another currency), whichever is higher. Such handling fee must be received by JPMFAL in cleared funds before the transfer is effected. You may arrange a bank transfer (and provide us with the payment proof) along with your transfer instruction.

Click here to download Form of Transfer.

For the Bank Transfer details, refer to the table below:

f. Dividends and Payout

Will I receive any regular income distribution from my investments?

Dividends not exceeding USD 250 (or its equivalent in another currency) will be automatically reinvested.

If you wish to receive cash distribution, please click here to download the MasterAccount Amendment Form section 6 with providing us a multi currency SPI bank account and section 7 to declare the dividend payment method.

Can the proceeds from the redemption of units/ shares through J.P. Morgan eTrading be paid in a currency other than that specified in my Standing Payment Instructions?

No. Payment can only be made in the currency specified in your Standing Payment Instructions (SPI).

To change the details of your existing SPI, simply login to J.P. Morgan eTrading and go to “My Account” > “Payment And Details” > “Standing Payment Instructions” then click into "Edit" to make the changes.

If you wish to add a new SPI setup, please login to J.P. Morgan eTrading and click “Set Up New Standing Payment Instructions” button to add the instructions. Please note that a request to set up a new SPI will replace all existing SPI setup.

If you wish to add or change a new overseas SPI setup, change or add a SPI setup as a Joint or Corporate Account user, please download, complete, and sign the MasterAccount Amendment Form and return the original to us by post at JPMorgan Funds (Asia) Limited, GPO Box 11448, Hong Kong.

After the submission of the MasterAccount Amendment Form, we will perform a callback to confirm the instructions.

Remarks:

Cash distributions are paid in the currency of the relevant class of units/shares. If your bank accounts on the SPI do not support receipt of payments in the relevant currency(s), your cash distribution will by default be reinvested or may, in some cases, be put on hold and your redemption payment will put on hold if a valid SPI is not completely set up in your MasterAccount. Hence, a multicurrency account is recommended.

Which bank account will the redemption proceed be made to, if my Standing Payment Instructions includes accounts in single foreign currency and multi-currency?

If the payment currency you selected in the redemption order is the same as your single currency bank account, payment will be made to that single currency account; otherwise it will be made to your multi-currency bank account

When will the dividends be distributed?

Kindly refer to the fund dividend record date and payment date under "Distribution" in JPMorgan Fund Explorer website.

Please note that individual funds have different pay date.

a. Personal Details

How can I change my personal information, such as email address, telephone number, address and my Standing Payment Instructions (SPI) online?

To update your personal information (email, phone number, address) simply login to J.P. Morgan eTrading and go to “My Account” > “My Personal Details” then click into "Update" to make the changes.

To change the details of your existing Standing Payment Instructions (SPI), simply login to J.P. Morgan eTrading and go to “My Account” > “Payment And Details” > “Standing Payment Instructions” then click into "Edit" to make the changes.

If you wish to add a new SPI setup, please login to J.P. Morgan eTrading and click “Set Up New Standing Payment Instructions” button to add the instructions. Please note that a request to set up a new SPI will replace all existing SPI setup.

If you wish to add or change a new overseas SPI setup, change or add a setup as a Joint or Corporate Account user, please download, complete, and sign the MasterAccount Amendment Form and return the original to us by post at JPMorgan Funds (Asia) Limited, GPO Box 11448, Hong Kong.

After the submission of the MasterAccount Amendment Form, we will perform a callback to confirm the instructions.

Remarks:

Cash distributions are paid in the currency of the relevant class of units/shares. If your bank accounts on the SPI do not support receipt of payments in the relevant currency(s), your cash distribution will by default be reinvested or may, in some cases, be put on hold and your redemption payment will put on hold if a valid SPI is not completely set up in your MasterAccount. Hence, a multicurrency account is recommended.

How can I submit or change my Autopay for my payment instructions on my MasterAccount's investment?

If you wish to change the Autopay details above, kindly view this page.

Will I receive confirmation of changes to my personal information?

Yes. A confirmation letter will be sent to you by email normally within one business day after you have submitted the change to us. If you have opt out of eStatements, a physical letter will be sent instead.

b. Portfolio/Holdings

Where can I check my portfolio breakdown and its latest valuation?

After you have login to J.P. Morgan eTrading site simply click My Portfolio.

Visit the link below for more information, please click here.

c. Transactions

What information can be maintained in "Existing Schedule"?

The Amount and Order Process Date (for monthly investment only) can be maintained in Existing Schedule.Orders on the existing schedule page cannot be deleted, however, you can suspend and/or reactivate scheduled order(s) in this page. However, you can suspend the scheduled order(s).The suspended order will be automatically deleted after 6 months. You cannot modify the fund name of the scheduled order(s).

Can I amend/suspend my scheduled order(s) on Order Process Date?

No. You can only amend your scheduled order(s)before the cut-off time one business day prior to the process date. To suspend or reactivate a scheduled order, you can change the scheduled order's status in Existing Schedule.

Can I increase or decrease my monthly investment on scheduled orders through eScheduler?

Yes. You can amend the amount of your monthly scheduled orders in Existing Schedule via J.P. Morgan eTrading before the dealing cut-off time on the business day prior to the effective date.

What kind of scheduled orders will be retained in "Existing Schedule"?

Scheduled order(s) which have not yet been processed will be shown in Existing Schedule for enquiry and maintenance purposes.

What kind of scheduled orders will be retained in "Order Status"?

When scheduled order(s) have been processed, but the transactions have not yet been completed, they will be shown in Order Status on the current business date for enquiry purposes.

To understand more about the different status, please refer to the table below:

What kind of scheduled orders will be retained in "Order History"?

All confirmed/completed transactions and rejected orders from the previous business day will be retained in Order History. The rejected orders will be removed from Order History after 7 days.

If I place order through J.P. Morgan eTrading, will I receive any email confirmation?

An eAcknowledgement, eConfirmation and Contract Note will be sent to your registered email address. Within the same day of receipt of your order(s), an eAcknowledgement will be sent to acknowledge receipt of your order(s).

Before the end of the business day, a consolidated eConfirmation will be sent to confirm whether or not your payment and order(s) have been received and accepted.

When your transaction is confirmed/completed, an Contract Note will be sent with full details of order(s) placed by you.

To view eAcknowledgement, eConfirmation and Contract Note, you will need Adobe Acrobat Reader. If you do not have the required software, please click here to download.

Glossary for "Order Status"

What kind of orders will be retained in "Order Status"?

All incomplete transactions and rejected/cancelled orders for the current business day will be retained in Order Status for your enquiry purposes.

How long will the orders be retained in "Order Status"?

Just within the current business day. For details of confirmed/completed transactions and rejected orders from previous business days, please go to Order History. Rejected/cancelled orders will be removed from Order Status after the cut-off time of the business day on which they were rejected/cancelled.

How do I enquire about my order status?

Simply click Holding & Transactions > Order Status

Glossary for 'Order History'

What kind of orders will be retained in "Order History"?

All confirmed/completed transactions and rejected orders from previous business day will be retained in Order History for your enquiry purposes.

Please note, rejected orders will be removed from Order History after 7 days.

What order types can I enquire about in "Order History"?

- Confirmed/Completed orders

- Orders rejected within the previous 7 business days

- Transfer transaction

- Distribution

How do I enquire about my order history?

Simply click Holding & Transactions > Order History

Where can I find Cash Account transaction history? (Applicable for account opened online on or after 27Feb2024)

You may find your Cash Account transaction history under “Cash Account” > “Balance & Transaction History”

Where can I see my Cash Account balance? (Applicable for account opened online on or after 27Feb2024)

The Cash Account balance is shown under “Portfolio”, or under “Cash Account” > “Balance & Transaction History”.

d. eStatements

What is the eStatement service?

eStatement is an electronic version of your paper statement. You can also retrieve your eStatement for the previous 24 months via the J.P. Morgan eTrading.

If you wish to receive eStatements, simply click My Account > Change Preferences for Contract Note & Statement

If I receive eStatements, will I still also receive paper statements?

No, you will only receive either eStatements or paper statements from us.

If you wish to receive eStatements, simply click My Account > Change Preferences for Contract Note & Statement

How do I know when my eStatement is available?

Your Statement will be ready by the 5th business day of each month. If you have selected eStatements, you can view the statements on your eTrading account.

If I change my email address on the last day of the month, will I receive my eStatement via my new email address afterwards?

Yes. After you have successfully changed your registered email address in our system, your eStatement notification will be sent to your updated email address.

What do I need to be able to view eStatement?

You will need Adobe Acrobat Reader to view your eStatement. If you do not have this software, please click here to download.

If I do not have any holdings and transaction records in my account during the month, will I still receive an eStatement or paper statement that month?

No. You will not receive either an eStatement or a paper statement that month.

How do I switch back to paper statements?

If you wish to receive paper statements, simply click My Account > Change Preferences for Contract Note & Statement

How can I retrieve / download my Cash Account Statement? (Applicable for account opened online on or after 27Feb2024)

Please login to J.P. Morgan DIRECT Investment Platform and at the top menu, select "Holding & Transaction" > “eStatement" to access and view your Cash Account statements.

e. Other (special cases) eg. Deceased

The account holder has passed on, how do I withdraw his holding?

I'm sorry to hear that, if your loved one has passed on, you may email us a copy of the death certificate at investor.services@jpmorgan.com so we may assist you further.

a. How to set up Order

What is eScheduler?

eScheduler is an online tool which allows you to pre-set your own investment schedule using a monthly investment plan in most of our funds via J.P. Morgan eTrading.

Can I set up a scheduled order for today?

No. You can only schedule future orders before the cut off time starting from the next business day and up to 3 months in advance.

Can I schedule orders for non-daily dealing funds through eScheduler?

No. Non-daily dealing funds cannot be subscribed to through eScheduler.

Can I schedule to invest monthly?

Yes. You can select 'monthly' frequency and the Order Process Day of each month. Your order(s) will be processed on your selected day of every month.

Click the link here for a more detailed guide.

What is Order Process Date?

Order Process Date is the date you have selected to process your scheduled order(s)

What are the charges for order(s) placed through eScheduler?

The same initial charges will apply to order(s) placed through eScheduler as will apply to order(s) placed in J.P. Morgan eTrading lump sum investments. Clients with client tiers suffixed by a “+” sign (e.g., Silver+, Gold+) are entitled to subscription fee waivers for subscriptions made through monthly eScheduler

Please view the table below for our fees and charges.

Is the "Birthday Offer" applicable to orders placed through eScheduler?

No. If you wish to use your "Birthday Offer", please place lump sum orders via eTrading page.

b. Order Processing

When will my scheduled order(s) be processed if the Order Process Date is not a dealing day?

If the Order Process Date is not a dealing day, your order(s) will be processed on the next dealing day.

Example 1

If the Order Process Date of the scheduled order is a Hong Kong Public Holiday, or a day when banks in Hong Kong are closed, or when a fund has a significant holding in a market that is closed, it will be processed on the next dealing day.

Example 2

If the Order Process Date of the future scheduled order(s) falls on the 29th, 30th or 31st of a month, and there are no such dates in the relevant investment months, the order(s) will be processed on the next dealing day(s).

What is the minimum investment of an order placed through eScheduler?

The minimum 'one-time' and 'monthly' investment for order(s) placed through eScheduler is HK$5,000 per fund and HK$1,000 per fund respectively.

On what date will my monthly contribution be debited from my bank account and whenwill it be invested?

For eScheduler monthly investment, your account will be debited on your selected Order Process Date of each month (or the next business day if the Order Process Date is a bank holiday) and your investment will normally be invested on the same day (or the next relevant dealing day, if the Order Process Date is not a dealing day).

For Traditional Regular Investment Plan, your account will be normally debited on the 4th business day prior to the 15th calendar day (or the next business day if it is a bank holiday) of each month, and will normally be invested on the 15th calendar day (or the next dealing day if it is a fund holiday).

How do I know if my scheduled order has been accepted?

An "eConfirmation" will be sent to your registered email address showing the status of your scheduled order. You can also check by going to Existing Schedule to view details of your orders for the current business day. For details of completed transactions, please go to Order History.

Will an electronic confirmation be sent to me after placing orders through eScheduler?

Yes, an eAcknowledgement - eScheduler setting, eReminder - eScheduler payment, eConfirmation, Contract Note will be sent to your registered email address.

An "eAcknowledgement - eScheduler setting" will be sent to your registered email address on the day of your newly set up or revised scheduled order(s).

An "eReminder - eScheduler payment" will be sent to you 2 business days before the Order Process Date of the scheduled order(s) to remind you of the upcoming schedule.

An eConfirmation will be sent to confirm whether or not your payment has been received and whether your scheduled order(s) have been accepted or rejected.

When your transaction is completed, a Contract Note will be sent.

Under what circumstances will a scheduled order be rejected?

Scheduled order(s) will be rejected if:

- For subscription order(s): your payments cannot be successfully debited from your Autopay bank account or you have not settled your scheduled order(s) through an eligible online payment method on the relevant Order Process Date by the cut-off time determined by your bank.

- For switching order(s): there is an insufficient residual balance in a fund or if there are insufficient available holdings in a fund on the scheduled set up day or/and the Order Process Date for switching orders.

- The relevant fund(s) have reached capacity limit and therefore are not currently open for subscription.

- The relevant fund(s) is suspended for dealing due to other reasons.

Any rejection will be notified to you by an email notification on the Order Process Date of the scheduled order(s), or the next dealing date, if the Order Process Date is not a business day.

If my monthly scheduled order is rejected this month, will the system process it again next month?

No. Once the monthly scheduled order is rejected by the system, all subsequent monthly order(s) under the same schedule will be automatically suspended.

Please go to eScheduler > Existing Schedule, then click update to reactivate the suspended order.

Will my suspended scheduled order(s) stay in "Existing Schedule" forever?

No. If suspended scheduled order(s) are not reactivated by you within 6 months of the suspension, they will be removed automatically.

c. Order Maintenance

What information can be maintained in "Existing Schedule"?

The Amount and Order Process Date (for monthly investment only) can be maintained in Existing Schedule. You can also suspend and/or reactivate scheduled order(s) in this page. You cannot modify the fund name of the scheduled order(s). However, you can suspend the scheduled order(s).

Can I amend/suspend my scheduled order(s) on Order Process Date?

No. You can only amend your scheduled order(s) before the business day of the Order Process Date. To suspend or reactivate a scheduled order, you can change the scheduled order's status in Existing Schedule.

Can I increase or decrease my monthly investment on scheduled orders through eScheduler?

Yes. You can amend the amount of your monthly scheduled orders in Existing Schedule via J.P. Morgan eTrading before the dealing cut-off time on the business day prior to the effective date.

What kind of scheduled orders will be retained in "Existing Schedule"?

Scheduled order(s) which have not yet been processed will be shown in Existing Schedule for enquiry and maintenance purposes.

What kind of scheduled orders will be retained in "Order Status"?

When scheduled order(s) have been processed, but the transactions have not yet been completed, they will be shown in Order Status on the current business date for enquiry purposes.

What kind of scheduled orders will be retained in "Order History"?

All confirmed/completed transactions and rejected orders from the previous business day will be retained in Order History. The rejected orders will be removed from Order History after 7 days.

d. Payment

How can I pay for my scheduled buy order?

eScheduler accepts payments made via Real Time Direct Debit (HKD) or HSBC’s Autopay (RMB).

Please refer to the links “Real Time Direct Debit (HKD)” or "HSBC’s Autopay (RMB)” for details.

If you wish to invest in JPMAM (China) Fund Range, a RMB DDA must be set up.

What is the daily payment limit on order(s) placed through eScheduler?

There is no daily payment limit imposed by J.P. Morgan eTrading on order(s) placed through eScheduler. The maximum payment amount using the Autopay is limited only by the amount set by you for your bank account.

Can I use different bank accounts to set up Autopay for settlement of scheduled order(s)?

No. The J.P. Morgan eTrading system only allows for one active Autopay bank account to settle scheduled orders for the same Order Process Date.

To set up your Real Time Direct Debit instruction, you first need to logon to eTrading. Then go to the “My Account” and press “Payment and Details”. Under “Autopay” function, press “Add eDDA”.

For more details, please click the link here.

When must funds be available in my bank account to settle orders?

Please ensure that sufficient funds are in your bank account to settle the scheduled order(s) the day before (depends on your bank) on the Order Process Date to avoid order rejection or a penalty for an unsuccessful debit charged by bank.

Can I invest in eScheduler with Cash Account balance? (Applicable for account opened online on or after 27Feb2024)

No. eScheduler can accepts payments made via Autopay (via eDDA) only.

Existing cash balance in the Cash Account will not be applied towards scheduled orders under eScheduler. On the Order Process Date, funds required to settle the scheduled order(s) will first be transferred from your Autopay Bank Account into the Cash Account, after which such funds will be transferred from the Cash Account and applied towards such scheduled order(s).

You must ensure that sufficient funds are in your Autopay Bank Account to settle the scheduled order(s) before the relevant cut-off time (as determined by your bank) on the Order Process Date to avoid order rejection of your order.

e. Regular Investment Plan (REIP) (Discontinued)

How do I make amendments to my REIP?

As of September 2021, setting up and making amendments to traditional Regular Investment Plan (REIP) with a fixed investment calendar are not longer supported.

If you wish to change your monthly investment instructions under your traditional Regular Investment Plan(s), you can terminate the Regular Investment Plan(s) and set up your new monthly scheduled orders via eScheduler.

Please download and fill in this form to terminate your REIP.

For setting up the eScheduler, please click here.

For setting up the payment, please click here.

How to migrate from REIP to eScheduler?

How do I terminate my REIP?

For existing holders of Regular Investment Plans, you can download and fill the Regular Investment Plan termination forms via fax to Fax: +852 2868 5013 or post it to JPMorgan Funds (Asia) Limited 19th Floor, Chater House, 8 Connaught Road Central, Hong Kong GPO Box 11448, Hong Kong.

What is the difference between REIP and eScheduler?

eScheduler is an online tool which allows you to pre-set your own investment schedule in most of our funds via J.P. Morgan eTrading. You may use ePoints to offset the initial charges.

While REIP is a traditional Regular Investment Plan with a fixed investment calendar. You will not be allowed to use ePoints to offset the initial charges.

a. General

How can I pay for my buy order through J.P. Morgan eTrading?

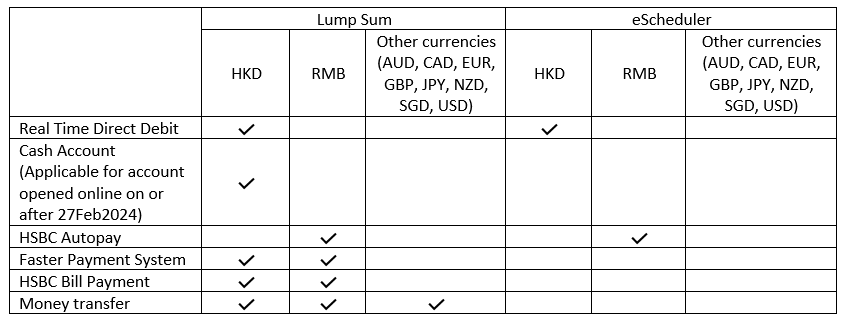

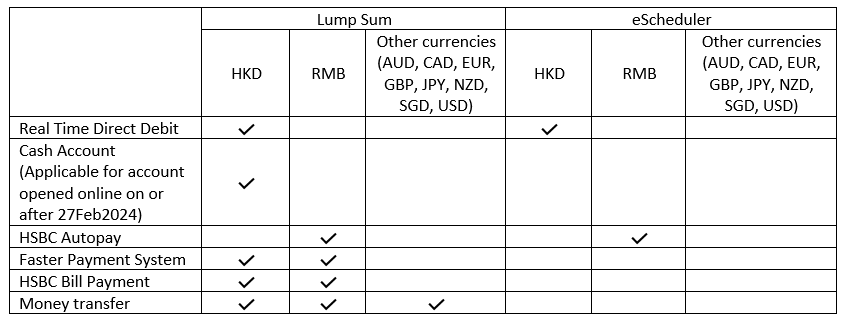

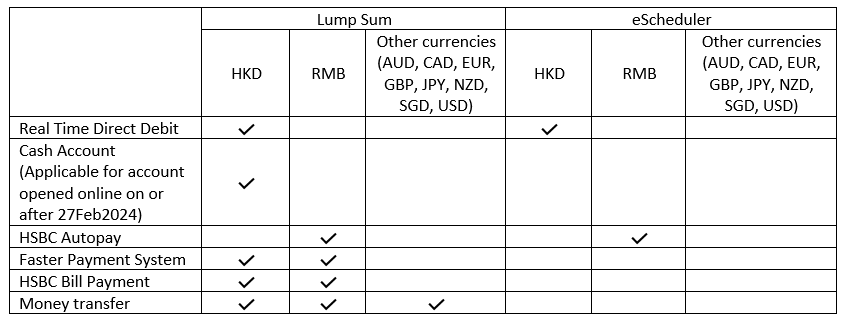

After proceeding to “Buy Order - Verification” page, you can either choose HSBC Real Time Direct Debit, FPS, RMB Autopay HSBC, HSBC bill Payment (via HSBC Internet Banking) and Money Transfer. The differences between these payment methods are listed below:

* HSBC/Hang Seng Bank's Autopay cannot be selected between 3:00pm – 5:00pm on the business day.

^ RMB payment can only be made via HSBC's Autopay.

Payment cutoff for different banks may vary. Order acceptance/rejection will be based on the payment details received from the respective banks.

In what currency can I settle my orders via HSBC Real Time Direct Debit, Autopay HSBC, HSBC bill Payment (via HSBC Internet Banking) or Money Transfer for my online buy order?

For HKD payment, it can be made via HSBC Real Time Direct Debit, HSBC bill Payment, FPS and Money Transfer.

For RMB payment (except JPMAM (China) Fund Range), it can be made via RMB HSBC's Autopay, FPS, HSBC Bill Payment and Money Transfer while payment forJPMAM (China) Fund Range can only be made via RMB HSBC's Autopay.

If I make payment in a currency other than the base currency of a fund, what rate of exchange will I receive and when?

Except for JPMAM (China) Fund Range (payment of which has to be made in RMB), conversion to the base currency of the fund will normally take place at the prevailing market rate on the dealing day.

When should I make payment in order to prevent rejection of my online buy order?

For more information of when the payment should be made, please refer to the table below:

Is there any payment amount limit?

For more information of the payment amount limit, please refer to the table below:

Can I make payment from a third party account?

No. You should not make payments by third party accounts.

b. eScheduler

For more information, please refer to the eScheduler page

c. Autopay

How do I set up HKD Autopay?

If you wish to add a new Autopay, please login to J.P. Morgan eTrading and click “Set Up New Autopay” button, or go to the respective bank’s website to add the instructions. Please note that a request to set up a new Autopay online will replace and combine all existing Autopay and Standing Payment Instruction (SPI) setup on your MasterAccount (account number starting with 88).

New Autopay setup requests will be set via electronic Direct Debit Authorization (eDDA).

If you wish to change the details of Autopay setup, please login to J.P. Morgan eTrading, you may go to “My Account” and “Payment and Details”, followed by clicking “Autopay” and “Set up New Autopay” button, or go to the respective bank’s website to amend the instructions.

For your Regular Investment Plan Account (i.e. account number starting with 77), the Standing Payment Instruction (SPI) will also be replaced by the same bank account. However, the Autopay on the Regular Investment Plan Account will remain unchanged.

If you wish to change or add an Autopay setup as a Joint or Corporate Account user, please download, complete, and sign the Direct Debit Authorisation (DDA) Form and return to us by post at JPMorgan Funds (Asia) Limited, GPO Box 11448, Hong Kong.

Remarks:

1. Funds must be available in your debit bank account before order placement, or execution of your eScheduler instruction on the relevant business day.

2. Order cancellation is not allowed after order confirmation.

3. For DDA setup, we only accept HSBC, Hang Seng Bank, Standard Chartered Bank, Bank of China, Citibank, Bank of East Asia and DBS Bank. Kindly download this form to setup.

4. To find out more details, please refer to the bank transfer information at the bottom of the demo page linked here.

How do I setup RMB HSBC Autopay?

There is no need to submit physical forms!

Simply set up your RMB HSBC Autopay online by following the link here.

It normally takes 3-5 days to process the set up.After we receive confirmation from your bank that the setup has been done,you will be notified by email. Please log in to J.P. Morgan eTrading site to activate the account.

How can I use RMB HSBC Autopay to pay for my buy orders?

Once you have setup RMB HSBC Autopay, simply follow the steps below to pay for your buy orders:

Place Order - Select the fund(s) you wish to subscribe and select "Sameday Autopay" then click "Confirm".

Payment – It is important that you ensure that there are sufficient funds in your RMB HSBC Autopay bank account to settle the order(s) before 3:00pm. Failure to do so will result in the order being rejected and possible penalty for an unsuccessful debit charged by the bank. Please also ensure that your order amount does not exceed the debit limit of your bank account setting.

Verify Order Status - You can see whether your payment has been made by going to Order Status which is normally refreshed at 10:00 pm every business day.

For further step-by-step procedures, please go to the Online Payment Demo.

Which bank are accepted for Autopay (via electronic Direct Debit Authorization (“eDDA”)) and Standing Payment Instructions (“SPI”) set up? (Applicable for account opened online on or after 27Feb2024)

For Autopay (via eDDA) and (SPI) setup, we only accept HSBC, Hang Seng Bank, Standard Chartered Bank, Bank of China, Citibank, Bank of East Asia and DBS Bank.

d. HSBC Bill Payment

How can I use HSBC bill Payment to pay for my buy order?

If you are already a user of HSBC Personal Internet Banking, please follow the steps in the link here to pay via HSBC bill Payment.

You can also visit the HSBC website www.hsbc.com.hk for HSBC Personal Internet Banking and HSBC bill Payment services enquiries.

If I have made payment via HSBC bill Payment but the total payment amount differs from the total amount of my buy orders made on the same day, what will happen?

J.P. Morgan eTrading has a "Payment Matching" mechanism to try to match your unpaid buy orders with your payments via HSBC bill Payment made on the same day.

Successfully "matched" payments and orders will be treated as paid and order successful. However, "unmatched" orders will be rejected and the "unmatched" payment amount will be parked in JPMorgan Money Fund - HK$ which can be switched to any other funds after 12:00 noon on the next dealing day.

e. Faster Payment (FPS)

How do I made payment via Faster Payment (FPS)?

Login to J.P. Morgan etrading to place your buy order and select “Faster payment system” as the payment method. Login to online banking, please select "Faster Payment System (FPS)" function. Enter the following information or directly scan the QR code for the payment after submitting your transaction.

1. Faster payment system identification code

(HKD – 3023058) (RMB – 3522752)

Payee: JPMORGAN FUNDS (ASIA) LIMITED-CLIENT MONIES

2. Transaction amount

3. Your MasterAccount No. on Payee Note or Reference (Please do not transact via "Faster Payment System" if the bank does not provide the field for MasterAccount No. because the system will not be able to identify your payment)

Remarks:

1. Third-party payment is not allowed. The payor's name must fully match the name of the MasterAccount holder.

2. The maximum transaction amount is subject to the limit of your bank account setting.

3. Registration is only required for receiving payments; registration is not required for outgoing payments.

4. For a step-by-step guide, refer to the link here.

f. Money Transfer

How do I make payment via Money Transfer?

1. Please follow your bank’s instructions to transfer to us the investment amount for the buy order you are going to place. Remember to keep the payment slip after scanning or taking a clear photo of it. To avoid rejection of your order, make sure that you transfer the exact investment amount. Do not split your payment for a single order into multiple transfers, nor pay for multiple orders in one single transfer. Please note that the time we receive the payment depends on the banking practices of the country(ies) concerned and our bank’s processing time for your transfer. Any charge(s) levied by the remitting bank should be excluded from the transfer amount. Our bank does not charge for the remittance.

2. Login to etrading select Lumpsum Investment > Buy from the top menu and enter the required information and select “Money Transfer” as the payment method. Then attach the scanned copy or image of the payment slip. To learn more about how to buy funds, please refer to the “Buy Funds” section in our online trading demo.

Remarks:

1. Money Transfer only supports lump sum transactions (excluding those made via eScheduler). Payment made via Money Transfer must be in the same currency as the one selected during order placement.

2. Payment must be made before your order placement. A copy of the payment slip must be submitted when you place the order.

3. Order cancellation is allowed before dealing cut-off time at 5:00pm. For JPMAM (China) Fund Range, orders can be cancelled before JPMAM (China) Fund Range dealing cut-off time at 3:00pm

4. To find out more bank account details please refer to the bank transfer information at the bottom of the demo page linked here.

Why is the beneficiary account information shown on my online banking system different from the information shown on your website?

For USD money transfer:

1. Some banks may populate additional XXX in the swift code. Both CHASUS33 and CHASUS33XXX are accepted by us.

2. Some banks may populate a different bank address. Given that the beneficary bank account number and swift code are correct, there should be no issue.

3. Some banks may ask for the Fedwire/ABA routing number, which is 021000021.

For HKD money transfer:

1. Some banks may ask for the beneficary account number in the format of Bank code – Branch code – Account number. Our HKD beneficary account number is 007 - 868 – 91920008.

Please feel free to contact our Investor Services team at (852) 2265 1188 if there is any concern.

a. Login

How to login?

To Login to your eTrading account, please go to our Login Page below.

1. Enter your Username or MasterAccount Number. Press “Next” to proceed.

2. Enter your Login Password. Press “Login” to proceed.

3. Select your preferred channel for receiving the One-Time Passcode (OTP). Press “Submit” to proceed. The OTP will be sent to you selected delivery channel.

4. Enter the OTP. Press “Submit” to proceed and login to eTrading.

Remarks:

- The voice OTP will be sent from an overseas number.

- Delivery of your OTP is subject to network conditions and the service quality of your service provider. If you have not received it within 15 minutes, please re-submit the request.

- For joint accounts, the OTP will be sent to the first applicant. For corporate accounts, the OTP will be sent to the delegated person.

To login to J.P. Morgan eTrading site follow the link here.

For a more detailed guide, click the link here.

b. Forgot/reset Password

How to reset my password?

To reset your password, please go to the Forget Your PIN/Password Page below.

1. Enter your Username or MasterAccount Number again and press “Submit” – the first One-Time Passcode (OTP) will be sent to your registered email address

2. Enter the first OTP and click “Submit”

3. Select your preferred channel for receiving the second One-Time Passcode (OTP). Press “Submit” to proceed. The OTP will be sent to you selected delivery channel.

4. Enter the second OTP and press “Submit”

5. Follow the instructions to set your Login Password and press “Change”.

6. Return to the Login page by pressing “Next” in the confirmation page – you can now log in with your new password.

Remarks:

- Delivery of your OTP is subject to network conditions and the service quality of your service provider. If you have not received it within 15 minutes, please re-submit the request.

- For joint accounts, the OTP will be sent to the first applicant. For corporate accounts, the OTP will be sent to the delegated person.

- The voice OTP will be sent from an overseas number.

Follow the instruction link here for Forget Your PIN/Password Page.

For a more detailed guide, click the link here.

c. Technical Issues

I am unable to receive my SMS OTP, what should I do?

If you are facing issues with the SMS OTP, kindly use the Voice OTP instead

What browser should I use to access J.P. Morgan eTrading site?

This site is optimised for viewing with Firefox or Chrome . We recommend that you use a browser with 256-bit SSL encryption capability as it provides the highest degree of security currently available for internet transactions.

If I have difficulty accessing J.P. Morgan eTrading site, can I download a better browser?

How can I ensure J.P. Morgan eTrading site is secure to use?

J.P. Morgan eTrading site use the industry standard encryption, 256-bit Secure Sockets Layer (SSL) Encryption, to ensure the privacy and security of your personal information and transactions made within J.P. Morgan eTrading site. You can always find a padlock symbol appears in the lower right hand corner of your browser to indicate that you are under protected.

a. Setting up the Account

How do I open an e-Trading Account

You can open an e-Trading Account either via the website, by mail or in person.

To open an e-Trading Account online follow the steps here.

If you wish to do it by mail please follow the steps below:

1. Kindly complete the account opening application online.

2. Include a personal cheque with an amount of HK$ 10,000 made payable to "JPMorgan Funds (Asia) Ltd", which will be temporarily invested in JPMorgan Money Fund – HK$, as part of the account opening identity verification procedures.

3. The payer's bank account must be under your sole name only.

4. The cheque signature must be the same as the signature provided for this online account opening application.

5. Print, sign and return the application form and all required supporting documents to us by mail. As long as you meet the eligibility criteria and have submitted all required documents, your account opening can be done within the 5 business days.

If you wish to do it in person please make an appointment at our office in Hong Kong by emailing our Direct Sales Team at jpmam.hk.direct@jpmorgan.com .

Please note that joint name account must be opened in person or by mail.

Office Hours: 9:00am - 12:00pm and 2:00 - 6:00pm (Monday-Friday except public holidays)

How long before I am able to start trading

As long as you meet the eligibility criteria, and have submitted all required documents with correct information provided, your account opening can be done as quickly as one business day. Once your account is successfully opened, you can start trading. (However, due to bank processing time, some applications may take longer).

How do I activate my e-Trading Account

To activate your eTrading account, please go to the New to eTrading Site Page below.

1. Enter your 12-digit MasterAccount Number which can be found from your Welcome to J.P. Morgan eTrading Site email. Then, click on "New to eTrading?".

2. Enter your MasterAccount Number and click “Submit” – the first One-Time Passcode (OTP) will be sent to your registered email address.

3. Enter the first OTP and click “Submit”.

4. Select your preferred channel for receiving the second OTP. Press “Submit” to proceed. The OTP will be sent to you selected delivery channel.

5. Enter the second OTP and click “Submit”.

6. Follow the instructions to set your Login Password and press “Change”.

7. Return to the Login page by pressing “Next” in the confirmation page – you can now log in with your new password.

8. You can create a Login Username anytime. Simply press “My Account” > “Create the Login Username” after logging in to eTrading.

Remarks:

- Delivery of your OTP is subject to network conditions and the service quality of your service provider. If you have not received it within 15 minutes, please re-submit the request.

- If you are unable to receive the SMS OTP, kindly switch to the voice OTP.

- For joint accounts, the OTP will be sent to the first applicant. For corporate accounts, the OTP will be sent to the delegated person.

- The voice OTP will be sent from an overseas number.

Can a foreigner open an account?

As of now, the eligibilty to open an account is as follows:

1. You are aged 18 or above

2. You are NOT a resident in or citizen of the United States (“US”) or otherwise a US person.

3. You have a bank account (Hong Kong dollar / multi-currency) at any of the following banks: Bank of China,Hang Seng Bank,HSBC,Bank of East Asia,Citibank, Standard chartered bank, DBS Bank.

4. You have a Hong Kong, China, Macau, Malaysia or Taiwan address

Can I create an account for my child?

As of now, the eligibilty to open an account is as follows:

1. You are aged 18 or above

2. You are NOT a resident in or citizen of the United States (“US”) or otherwise a US person.

3. You have a bank account (Hong Kong dollar / multi-currency) at any of the following banks: Bank of China,Hang Seng Bank,HSBC,Bank of East Asia,Citibank, Standard chartered bank, DBS Bank.

Thus, you will not be able to open an account for your child if they are underage. If you like to purchase funds for your child, please approach your local banks for more information.

If you would like to open an account for yourself, kindly use the link here.

How do I open a MasterAccount with Cash Account service?

To open a MasterAccount online with Cash Account service, you have to submit your account opening application online (you may find the details here). As part of the account opening identity verification procedure, you are required to successfully transfer HKD10,000 from your registered Specified Bank account to JPMorgan Funds (Asia) Limited pursuant to local regulatory requirements. This HKD10,000 will be available as Cash Account balance under your MasterAccount if account opening is successful. If account opening is unsuccessful, the HKD10,000 will directly be refunded to the same bank account provided (Please note that your bank may impose charges on the refund).

Is my MasterAccount entitled to Cash Account service if I submit account opening application by mail?

Cash Account service (which forms part of the MasterAccount)is only available to MasterAccount successfully opened via online account opening applications.

Is there any Cash Account service for MORGAN DIRECT clients with accounts opened before 27 February 2024?

Cash Account facility will only be applicable to customers completing online account opening application on or after 27 February 2024.

b. Documents submission

What documents do I need to open an account?

You will need the following documents to open an account:

1. An image of your Hong Kong Identification Card or Passport

2. Information of your bank account with any of these Hong Kong licensed banks.

3. An image of your signature on a white background

How do I submit the documents to JP Morgan?

If you open an account online, you may submit the forms by uploading them during the application process.

Otherwise, you may submit it by Mail using the following steps:

1. Complete the account opening application online.

2. Include a personal cheque with an amount of HK$ 10,000 made payable to "JPMorgan Funds (Asia) Ltd", which will be temporarily invested in JPMorgan Money Fund – HK$, as part of the account opening identity verification procedures.

- The payer's bank account must be under your sole name only.

- The cheque signature must be the same as the signature provided for this online account opening application.

3. Print, sign and return the application form and all required supporting documents to us by mail.

As long as you meet the eligibility criteria and have submitted all required documents, your account opening can be done within the 5 business days.

If you prefer to do it in person, please follow the steps below:

1. Make an appointment at our office in Hong Kong:

2. Email our Direct Sales Team at jpmam.hk.direct@jpmorgan.com .

3. Office Hours: 9:00am - 12:00pm and 2:00 - 6:00pm (Monday-Friday except public holidays)

I am facing issues uploading my documents, what should I do?

You may either submit your documents by post or in person.

Please do not provide a joint name/different name bank account as we do not accept third party payment. In results, you will not be able to proceed with the online application.

c. Promotions

Are there any sign-up bonuses being offered?

To find out more about our sign up offers, please pay attention to any promotion for new applicants when you open the account.

How can I get the MORGAN DIRECT cash rewards (Welcome cash rewards and Referral cash rewards)?

Please refer to this page for campaign details. Terms and Conditions apply.

How can I check my referral code?

Please login to J.P. Morgan Direct Investment Platform, your referral code (if applicable) will be shown on the top right corner.

d. Guidance

Does JP Morgan offer any investment guidance?

As we are not a brokerage, we do not provide any investment guidance/advice.

a. Birthday Offer

What is the "Birthday Offer"?

The "Birthday Offer" is when subscription/switching charge on all Buy and Switch orders on Lump-sum investments are waived on a day (00:00-23:59) of your choice in your birthday month each year.

(Please note that investing in our funds involves ongoing charges up to 2.63%*).

* Click here for details about the ongoing charges.

How can I use the "Birthday Offer"?

You can use the “Birthday Offer” privilege when you place orders online. To use the "Birthday Offer" please remember to select the “Birthday Offer” option from the Initial Charge. Do ensure that the initial charges reflects 0 before submission.

How many orders are eligible for the "Birthday Offer"?

There is no limit on the number of orders. Only lump-sum investments orders placed on the selected calendar day (00:00-23:59) are eligible for the “Birthday Offer”.

If I have multiple accounts, which ones are eligible for the "Birthday Offer"?

"Birthday Offer" is applicable to sole accounts and to the first applicant of a joint account, provided that the birthday information has been given. It is not applicable to the accounts of corporate clients.

Is the "Birthday Offer"applicable to orders placed via other channels?

No, "Birthday Offer" is only applicable to buy and switch orders via J.P. Morgan eTrading (excluding orders placed through eScheduler)

Will the "Birthday Offer" be re-offered the next day if the transaction is rejected?

“Birthday Offer” can only be used on the particular day that you have selected in your birthday month each year. It will not be re-offered the next day after a transaction failure due to an invalid application or insufficient money in the designated account.

Will the "Birthday Offer" be re-offered if I cancel the order(s)?

Yes, if you cancel all orders (Buy/ Switch) that enjoy the 0% subscription/switching charge before the cut-off time of 5:00pm on the same business day on which you place the order.

If you have selected Sameday Autopay to settle your lump-sum orders or if you're buying/switching JPMAM (China) Fund Range, you would have to cancel the orders before 3:00pm.

(Please note that investing in our funds involves ongoing charges up to 2.63%*)

* Click here for details about the ongoing charges.

b. ePoints

What are "ePoints"?

To encourage our clients to manage their fund portfolios online, J.P. Morgan eTrading is introducing an ePoints reward scheme. ePoints will be awarded whenever clients place Buy/Switch order(s) for new units through J.P. Morgan eTrading. Accumulated ePoints can later be used to waive the initial charge for online Buy/Switch order(s).

Find out more about our ePoints reward scheme in the link here.

How can I check the balance of my ePoints?

Your current ePoints balance will be shown in the "Buy"/ "Switch"/ “Sell”/ "My Portfolio"/ “Post-Login” screens of J.P. Morgan eTrading. ePoints will be spent immediately after order placement where as ePoints will be earned after order completion.

Can I check the amount of ePoints earned/spent in a particular order?

The amount of ePoints earned/spent will be shown in the eContract note and the Order Status/Order History for that particular order.

How many ePoints will I earn if I subscribe HK$5,000 to an equity or bond fund?

500 ePoints- i.e. you earn 1 ePoint for every HK$10 subscription to an equity or bond fund.

How many ePoints will I earn if I subscribe HK$5,000 to a money fund?

None, since the initial subscription charge for money funds is 0%.

How many ePoints will I earn if I place a HK$10,000 switch order to switch from one equity or bond fund to another?

Client is no longer to earn any ePoints from old money switching since switching fee is no longer to be applied.

Are the ePoints earned for a lump sum investment subscription the same as for an eScheduler subscription for the same amount?

Yes, the total will be the same. Orders placed through "eScheduler" earn ePoints at the same rate as a lump sum investment.

If I place Buy/Switch order(s) to earn ePoints on 16 June 2022, what will be the expiry date?

The ePoints that you earn on 16 June 2022 will remain valid until 23:59 on 31 Dec 2023. ePoints do not expire until 23:59 on 31 December in the year following the year of award.

How do I know the total amount of ePoints earned in online Buy/Switch order(s)?

For lump sum investments the total amount of ePoints earned will be indicated on the dealing screens of J.P. Morgan eTrading during order placement.

For eScheduler investments, ePoints will be earned on your selected order processing date. In this case you can check the number of ePoints earned in the eContract Note(s) and Order History after order completion.

Alternatively, you can check your current ePoint balance on the "Buy"/ "Switch"/ “Sell”/ "My Portfolio"/ “Post-Login” screen of J.P. Morgan eTrading.

If I subscribe HK$5,888 to JPMorgan Asian Total Return Bond (mth) - USD via J.P. Morgan eTrading, how many ePoints will I earn?

588 ePoints. Please note that ePoints earned are always rounded to the nearest whole number.

Will I earn ePoints for Buy/Switch order(s) where the initial charge is waived using ePoints?

No, in this case ePoints will not be awarded.

Will I earn ePoints for Buy/Switch order(s) that enjoy the "Birthday Offer" - 0% initial charge?

No, ePoints will not be earned for such order(s).

Are ePoints applicable to orders placed through other service channels besides J.P. Morgan eTrading?

No, ePoints apply only to Buy/Switch order(s) via J.P. Morgan eTrading

How can I use my accumulated ePoints to waive the initial charges for lump sum investments?

If you want to waive the initial charge for a lump sum investment using ePoints, please select the "ePoints" option from the Initial Charge in the dealing screens.The initial charges will be waived given that you have enough epoints to waive the initial charge for that transaction.

How can I use my accumulated ePoints to waive the initial charges for my "eScheduler" orders?

ePoints are automatically used to waive the initial charge for eScheduler orders, provided your ePoints balance is enough to do so on the order processing date.

Can I use ePoints to partially waive the initial charge for my subscription orders?

No, ePoints cannot be used to partially waive initial charges.

If I choose to waive the initial charge (assuming it is 1%) for my subscription order(s) for HK$10,000, how many "ePoints" will be required?

5,000 ePoints. Please note that for new subscription orders the number of ePoints required depends on the initial charge and the investment amount.

If I have accumulated ePoints where some expire in 2020 and others expire in 2021, which will be spent first when I use them to waive my initial charges for online subscriptions?

The ePoints with a 2020 expiry date will be used first. The system automatically "spends" ePoints on a first-in, first-out basis.

Will the ePoints spent be reimbursed if I successfully cancel my Buy/Switch orders via J.P. Morgan eTrading?

Yes, ePoints spent will be reimbursed if you cancel Buy/Switch orders successfully before the 5pm Hong Kong cut-off time.

(Please note the cut-off time for JPMAM (China) Fund Range is 3PM)

If I have eScheduler order(s) due to be executed today and I place a lump sum order this morning as well, how will I know if the ePoints will be waived for the eScheduler order(s) or the lump sum order?

ePoints will be automatically used to waive your initial charges if you have enough ePoints at your eScheduler order(s) generation time.

You can check the amount of ePoints spent on the Order Status/Order History/eContract Note for your eScheduler order(s). For lump sum investments, if you have enough ePoints during order placement, "ePoints" will be shown in the 'Initial charge' pull-down menu. You can then decide whether or not to use ePoints to waive the initial charge for your lump sum order.

Will I receive ePoints for my first fund subscriptions via the Online Account Opening Application?

Client is no longer to earn any ePoints from first fund subscription via the Online Account Opening Application since there is no subcription fee for the money market fund scription.

Is ePoints applicable when opening a new account via postal application, or any other service channel?

Client is no longer to earn any ePoints from first fund subscription via postal application, or any other service channel since there is no subcription fee for the money market fund scription.

Is ePoints applicable to regular investment plan set up via J.P. Morgan Investment Center?

No, ePoints is not applicable to any other service channel apart from J.P. Morgan eTrading.

If I hold two MasterAccounts under JPMorgan Funds (Asia) Limited, can I transfer some or all of my ePoints from Account "A" to Account "B"?

No, pooling or transferring ePoints between different MasterAccounts is not allowed.

c. Account Tiers

What are the different account tiers?

Currently there are 3 account tiers. They are Platinum, Gold and Silver.

More details on the client tier can be found in our dealing guide.

How do I become a silver/gold/platinum member?

Here are the minimum account balance you should maintain for each tier:

Silver:Less than HKD$200,000

Gold:Between HKD$200,000 to HKD$7,500,000

Platinum:More than HKD$$7,500,000

More details on the client tier can be found in our dealing guide.

What are the benefits of being a silver/gold/platinum member

To find out more about the benefits and eligibility click on the link here.

d. Current marketing campaigns

Are there any sign-up bonuses being offered?

To find out more about our sign-up offers, please pay attention to any promotion for new applicants when you open the account.